car sales tax wake county nc

Vehicle Taxes Taxes North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is. In addition to taxes.

New Businesses Coming To Wake Forest Town Of Wake Forest Nc

Things You Can Now Do At Home.

. The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. The calculator should not be used to determine your actual tax bill. Johnston street smithfield nc 27577 collections mailing.

Payment Plans Prepayments Get information on making. Business and motor vehicle accounts. Fast Easy Tax Solutions.

The law transfers responsibility of. Test Drive A Car. Review Competing Quotes Before Going to the Dealer.

Ad Shop for New Used Autos Online Get Delivery Straight to Your Door. The minimum combined 2022 sales tax rate for Wake County North Carolina is 725. 35 rows Sales and Use Tax Rates Effective October 1 2020 Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in.

The December 2020 total local sales tax rate was also 7250. The North Carolina state sales tax rate is currently. For vehicles that are being rented or leased see see taxation of leases and rentals.

This is the total of state and county sales tax rates. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined. Your county vehicle property tax.

Enter Zip Request Free Quotes Today. North Carolina collects a 3 state sales tax rate on the purchase of all vehicles. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

Avery Brunswick Camden Chowan Columbus Currituck Dare Davie Gates Hyde Mitchell Pamlico Tyrrell Vance and Washington counties have the lowest total tax rate of 675. Ad Find Out Sales Tax Rates For Free. Ad Huge Price Cuts in Your Area Car Inventory.

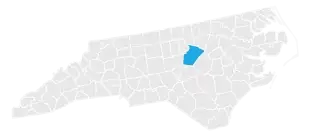

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists. The current total local sales tax rate in Wake County NC is 7250. Children Family Services.

In 2005 the North Carolina General Assembly passed a law to create a combined motor vehicle registration renewal and property tax collection system. 025 lower than the maximum sales tax in NC. This calculator is designed to estimate the county vehicle property tax for your vehicle.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. Take The Kids To School.

Meet In The Street Town Of Wake Forest Nc

Wake County Nc Property Tax Calculator Smartasset

Wendell North Carolina Nc 27591 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

North Carolina Nc Car Sales Tax Everything You Need To Know

Wake County To Recognize Alternative Form Of Id For Immigrants Refugees Wral Com

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

2020 Wake County Visitation Figures Released

Wake County Restocking Free N95 Masks On Tuesday Wral Com

Vincent Allen Project Archives The Old House Life Old Things Updating House Old House

Deputies Rash Of Luxury Cars Broken Into Stolen In Wake County Wral Com

Buick Gmc Lease Deals And Incentives Raleigh Nc Wake Forest Cary

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More